Emergency Medical Travel Insurance – 10 Million coverage, starting $45/Year, Click any company name to buy now

If you want complete package, prices starting at $29/Month, please click the following link to get a quote

Why is Medical Insurance for Truck Drivers is Required?

First, the Canadian provincial health plans do not cover medical care outside of the provinces or provide limited coverage outside of the provinces. Nevertheless, most of truckers drive across Canada or to the USA.

In addition, if a trucker is involved in an accident outside of the home province, particularly outside Ontario, one might have to pay the hospital bills out of pocket. So,this could result their family may face financial hardhsip.

A third reason is that trucking is a hard job, prone to hazardous situations, because it involves being on the road, dealing with inclement weather, and working long hours.

Finally, you need insurance to support your family, since expenses, mortgages, and bills continue even if you cannot work.

Which medical insurance is good for truck drivers?

Insurance bundles that cover travel, accidental death, dismemberment, disability, soft tissue, and illness are the ideal for truckers. Besides these add-ons and benefits, some insurance companies also offer extras, such as health benefit plans in group policies.

Optional Add-ons in medical insurance for truckers bundle

Illness Cover– In trucking, especially long haul drivers, are prone to illnesses, because of cab shivering and plastic interiors. So, the illness coverage is not pinching, it is worth it to save your enterprise.

Total Disability– A lump sum payment plans are also available and it can be a top up in the package, one time paid out and offered by most disability insurance companies.

Even more addons such as lifestyle protection enhancer, health and dental benefit plans, and family coverage plans are also available in the market.

Almost everyone is eligible for a trucker insurance package, with a valid status in Canada.

An experienced insurance advisor can help you choose the right medical insurance plan. We specialize in Truck Driver Medical Insurance, and work with all major insurance companies.

Individual vs group emergency medical insurance for truck drivers.

For trucking companies, group plans are cheaper than individual plans. You can get a great discount if you have over 20 drivers and the discount increases with the number of drivers. Talk to our expert about emergency medical insurance for trucking companies. We have already designed a lot of plans. Now let’s start yours.

Things to keep in mind when buying emergency medical insurance for a truck driver.

– Always buy a multi trip plan.

– Make sure that you buy disability insurance based on your income, because the benefits are based on it.

– Buy the right insurance. If you already have a policy, let us review it for you.

– Prefer a policy with 24-hour coverage, as it will provide coverage in the event of an accident outside the truck.

The following are the basic components of every coverage.

– 5 million emergency hospital coverage.

– 24 hour support.

– Hospital food and accommodation.

– Ambulance call.

– Lab tests.

– Prescription medicines.

– Healthcare equipment.

– Unlimited trips.

– Return home in case of an emergency.

– Emergency air travel.

– Travel of companion to the home.

– Return of the vehicle home.

– Emergency dental treatment.

Buy online now, Click on the Edge Express Quote.

Now, it opens up in a new browser(make sure pop-ups are not blocked). Click on the “INCOME REPLACEMENT BENEFITS” as pointed in the picture.

Now, it opens up in a new browser(make sure pop-ups are not blocked). Click on the “INCOME REPLACEMENT BENEFITS” as pointed in the picture.

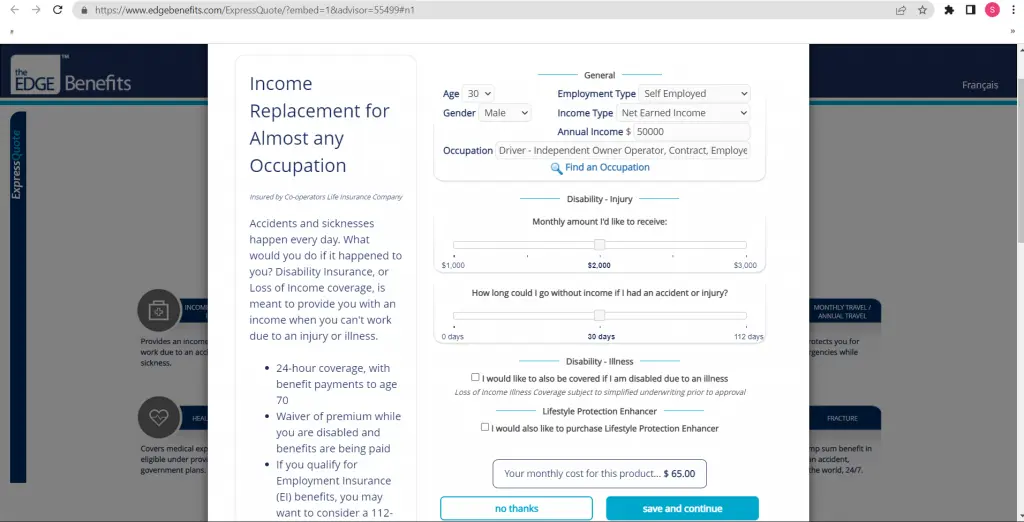

Fill up your details, click “SAVE AND CONTINUE” as shown in picture: age, gender, employment type, income type, annual income, monthly benefit amount you would like to receive and waiting period. Please note that they already set the benefit period to age 70 in the online quote.  Select “ACCIDENTAL Select ” ACCIDENTAL DEATH AND DISMEMBERMENT” and select the type and amount you would like to receive in the pop up, and click “save and continue” as shown in the picture.

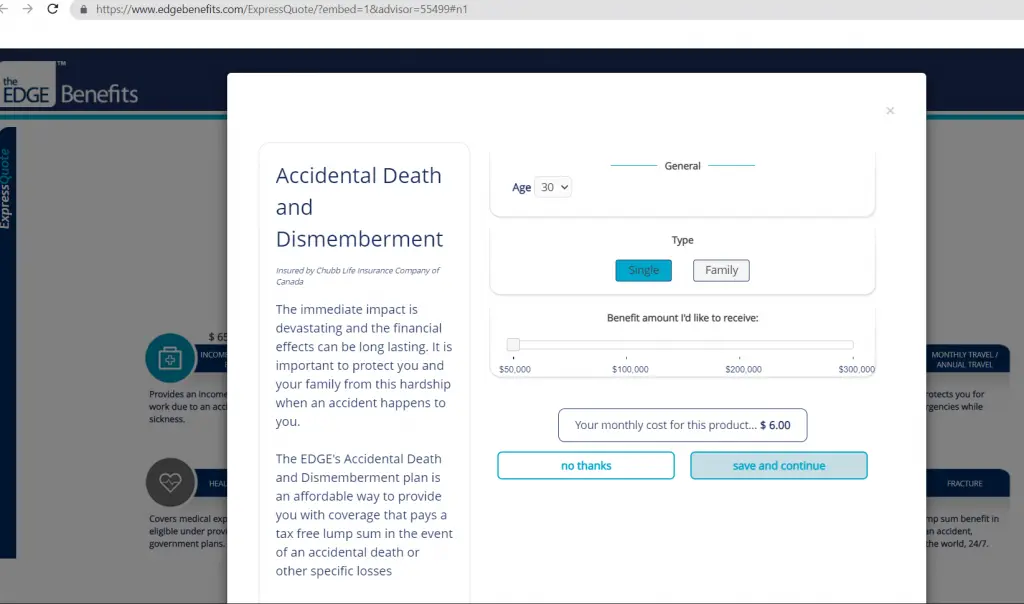

Select “ACCIDENTAL Select ” ACCIDENTAL DEATH AND DISMEMBERMENT” and select the type and amount you would like to receive in the pop up, and click “save and continue” as shown in the picture.

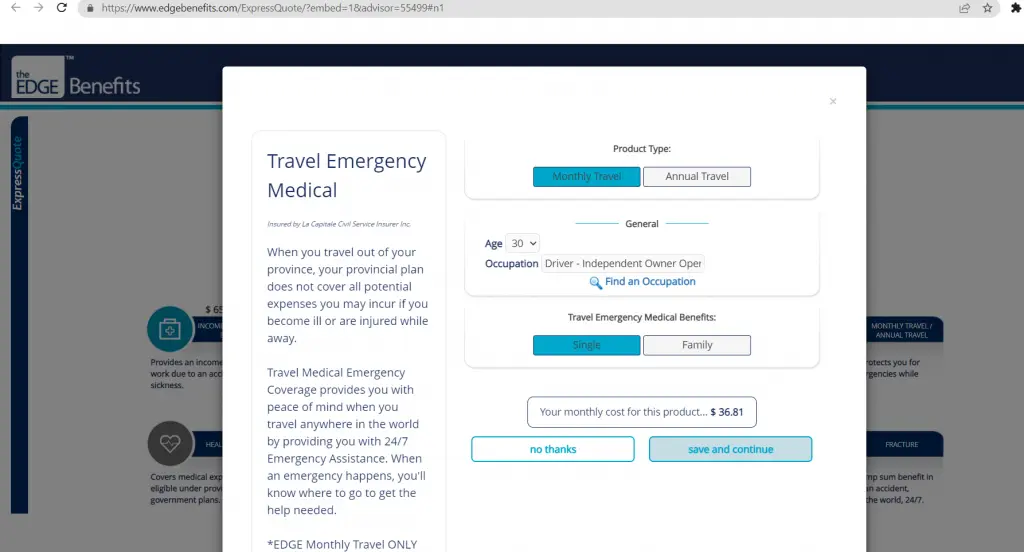

Now click “MONTHLY TRAVEL/ANNUAL TRAVEL” and select monthly travel and single and click “save and continue” as shown in the picture.

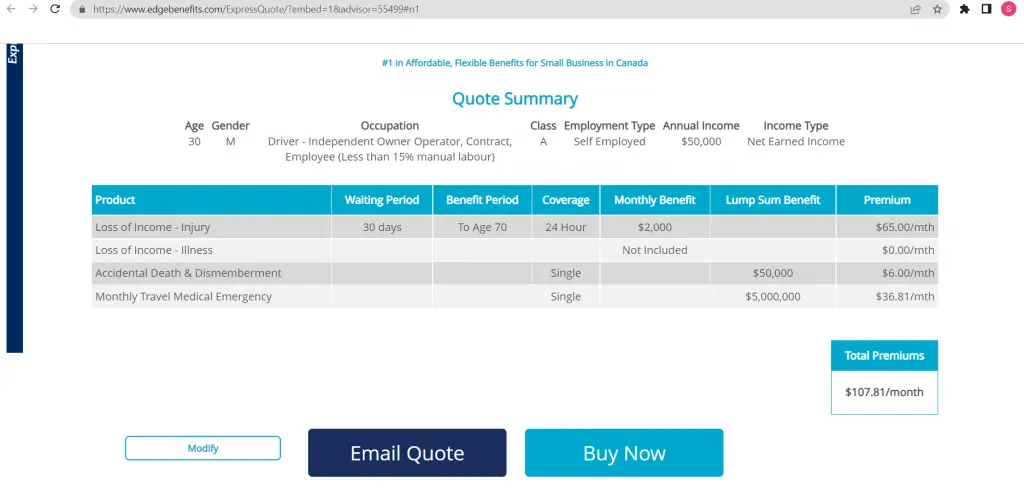

Now on the last screen, click “continue to Summary” and it will redirect you to the last page, as shown in the picture. You have two options: “Email Quote” “Buy Now”, select which one you want, “Buy Now” to complete the purchase or “Email Quote” for detailed information.

Contact us for more information and to prepare an emergency medical insurance plan. Let’s make a plan for you, add a multi life discount and customize it according to your budget and needs. We are available on our social contacts.

Leave a Reply